Integrated Advisor Network advisor Peter Andersen of Andersen Capital Management successfully offers private and alternative investments to his clients. He does this via Proteus, one of our Alliance Program Partners. Growing trends and challenges in private markets mean they are actively seeking solutions to expand access for more investors. So how does Proteus help Integrated advisors with that?

How to Work With Proteus

Proteus works with RIAs, family offices and private banks to make the exercise of investing in institutional-quality alternative funds less of a burden. They have a menu of about 50 different private credit funds, hedge funds, private equity funds, co-invests and real asset funds on their platform (all non-registered products).

Peter chose Proteus to establish his Weather Mark Long Short hedge fund for several reasons, including that they are similar to Integrated Advisors Network in many ways. Proteus is an RIA and therefore has the fiduciary responsibility for anything they put on the platform — due diligence is assured for each of the funds. They offer access through a single, electronic subscription agreement. Regardless of how many co-invests or funds in which you elect to invest, there is only one subscription agreement to sign.

Education is at the forefront of Proteus, so ongoing support for you and your investors makes sure that everyone is educated on asset classes and investments. Add to that consolidated private investment portfolio reporting and K1s, as well as the additional flexibility to structure custom fund vehicles for your firm.

The Growth of Private Market Funds

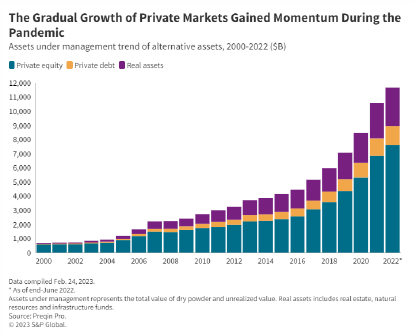

Opportunities in the private markets are expanding. Over the last 22 years, assets under management in private market funds has grown from approximately $750 million to $11.5 trillion.1 In comparison, the total market capitalization of public U.S. companies as of June 30, 2023 was $46.1 trillion.2 More companies are now staying private or even moving from public to private. So financial advisors will likely find themselves in a position very soon or even now where clients start asking how they can add private or alternative investments to their portfolios.

Getting Started with Private Market Investments

Investing in the private markets was once an opportunity only for the wealthiest of families and institutional investors like endowments, pension funds and foundations. Why was that the case? There are four common reasons why investing in the private markets has been so difficult for most of the population.

1. Access to Deal Flow

Do you know an owner of a private company looking to raise capital? Most of us do not. Typically, only the uber wealthy get offers from other wealthy business owners to invest in their companies. The rest of us merely invest through the public stock and bond markets.

2. Private Market Funds with High Minimums

Funds such as Private Equity funds help with the problem of accessing deals directly. The managers of these funds get access to deal flow and investors pool capital together to invest in multiple deals. Sounds great. However, the minimums required to access the top performing funds typically start at $10 million. Even for a wealthy household, that is not a reasonable minimum.

3. Time and Resources to Manage a Portfolio of Private Investments

Subscribing to a private fund is much different than purchasing a public stock or bond. It is more like opening a mortgage. Subscribing to a private fund typically requires the investor to complete a forty-page subscription agreement for every fund in which the individual invests. After the subscription process, the fund will call for portions of the capital committed from the investor at irregular intervals. Reporting can be opaque and is typically very delayed. Most private funds issue K1s well after the April tax deadline.

4. Finding the Best Managers

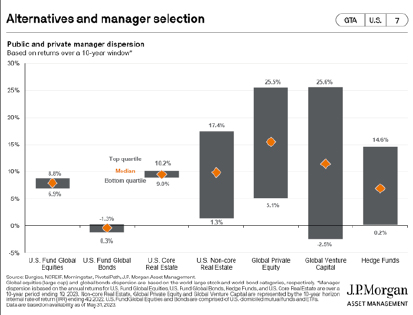

Let’s say you do have $10 million to invest in a Private Equity fund and you have the time and resources to handle the administrative burden just described. How do you know which fund is the best? Unlike the public markets, fund managers that perform in the top quartile tend to stay in the top quartile in the private markets.3 Check out the graph below. Many financial advisors do not have years of experience analyzing private market investments or hold CAIA (Chartered Alternative Investment Analyst) designations. It’s vital to select the best managers to make the extra work worth the investment.

To learn more about Proteus and the Integrated Platform, contact Linda Pix.

1 Source: Preqin

2 Source: https://siblisresearch.com/data/us-stock-market-value/

3 Source: JPMorgan Guide to Alternative Investments Q2 2023

This document does not constitute an offering of any security, product, service, fund, or any other pooled investment vehicle (each, a “Fund”) managed and advised by Proteus, LLC, a registered investment advisor registered with the SEC (“Proteus”), for which an offer can only be made to qualified investors through a Fund’s Confidential Offering Memorandum (the “Memorandum”) prepared by the Fund.